Home »

Get the most out of Universal Child Care Benefits

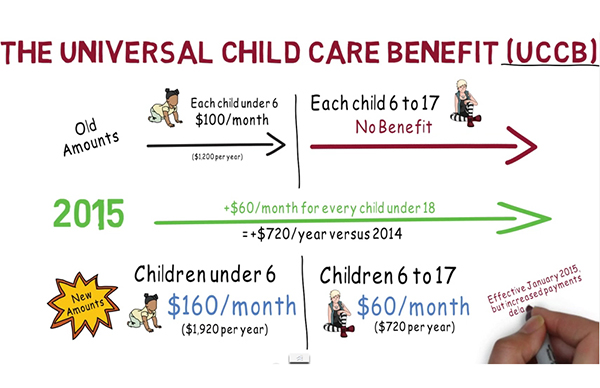

Recently, to the delight of parents everywhere, retroactive Universal Child Care Benefits were mailed out dating back to January 1. Parents received $520 for every child under the age of six and $420 for every child aged six to 17. Households with multiple children received a large lump of funds totalling upwards of a thousand dollars. But now the question remains of how to do the most with that money.

Here are some great ways you can plan for your children’s futures.

Start an RESP

Putting your child’s money away into an RESP (Registered Education Savings Plan) is an excellent way to start saving for their future. Not only should you gain a good return on your investment, but you will then have access to the Canada Education Savings Grant. This is a matching savings grant, which could pay up to 40% on each and every dollar you contribute.

If you would like something a bit more liquid than an RESP then maybe a Tax Free Savings Account (TFSA) will work better for you. Here you can earn investment dollars but still be able to use the money as you see fit without paying tax to do so.

Education Grants

There are several government grants that every parent should look at in conjunction with their child’s RESP. The Canada Education Savings Grant provides an incentive to your family to save for your child’s post-secondary education. The government will contribute an additional 20% on top of the contributions you and your immediate family contribute. If you contribute $100 then the government will contribute $20 up to a maximum of $7,200. As an added benefit, if your annual household income is below $87,123 then you may qualify for an even larger government contribution.

Another option available for low income households earning less than $43,953 annually is the Canada Learning Bond. If you have children born after January 1, 2004 all you need to do is open up an RESP for your child and an amount of up to $2000 will automatically be deposited.

Regardless of how you choose to use your child’s Universal Child Care Benefit you should be aware of the options open to you and your family. If you would like more guided advice please feel free to contact your local financial planner who can offer you an excellent strategy for setting your children up for their future education. It is never too early to start planning for the rest of their lives.

– Riki Unrau is a Mortgage Broker with Invis Williams and Associates, located at 828C Baker Street, Cranbrook, BC V1C 1A2 – 250-919-6402. For more try: www.facebook.com/rikiunraumortgages