Home »

Invermere area properties still most valuable

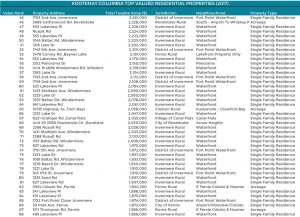

Invermere and area remains the high end for property values in the East Kootenay, according to the latest information from BC Assessment.

Eight of the 10 top valued properties in the region are located in and around Invermere, with rural Fernie taking the other two top 10 spots. Further, 69 of the top 100 priciest properties in the region are located in Invermere and area.

The top valued (total taxable value) property in the region according to BC Assessment is located on Lake Drive (east side of Lake Windermere), with a value of $5,462,000.

This information is part of the package released today by BC Assessment, telling taxpayers in the Kootenay Columbia region their 2017 property assessment notices are in the mail.

In the next few days, owners of more than 143,000 properties throughout the Kootenay Columbia can expect to receive their 2017 assessment notices which reflect market value as of July 1, 2016.

“The majority of residential home owners within the region can expect an increase, compared to last year’s assessment,” said Ramaish Shah, Deputy Assessor for the Kootenay Columbia region. “There are some markets that have moved more than others. Nelson, for instance, has seen strong demand for housing over the past year. Some areas have seen a decrease in demand as well, and this is reflected in the current assessed values.”

As B.C.’s provider of property assessment information, BC Assessment collects, monitors and analyzes property data throughout the year.

The Kootenay Columbia region covers the southeast portion of province from the Elk Valley to Grand Forks and from Revelstoke to Cranbrook. Overall, the Kootenay Columbia region‘s total assessments increased from $37.89 billion in 2016 to $38.60 billion this year. This value reflects a change due to market movement as well as $491 million in growth due to subdivisions, rezoning and new construction.

The following provides estimates of typical 2016 versus 2017 assessed values of residential homes in the East Kootenay. These examples demonstrate market trends for single-family residential properties.

City of Cranbrook – 2016 – $269,000; 2017 – $270,000; $1,000 increase.

City of Fernie – 2016 – $448,000; 2017 – $451,000; $3,000 increase.

City of Kimberley – 2016 – $228,000; 2017 – $228,000; no increase.

District of Elkford– 2016 – $266,000; 2017 – $272,000; $6,000 increase.

District of Invermere – 2016 – $371,000; 2017 – $380,000; $9,000 increase.

District of Sparwood – 2016 – $310,000; 2017 – $283,000; $27,000 decrease.

Village of Canal Flats – 2016 – $176,000; 2017 – $151,000; $25,000 decrease.

Village of Radium Hot Springs – 2016 – $328,000; 2017 – $305,000; $23,000 decrease.

BC Assessment’s website at bcassessment.ca includes more details about 2017 assessments, property information and trends such as lists of 2017’s top valued residential properties across the province. The website also provides self-service access to the free online e-valueBC service that allows anyone to search, check and compare 2017 property assessments anywhere in the province.

“Property owners can find a lot of information on our website including answers to many assessment-related questions, but those who feel that their property assessment does not reflect market value as of July 1, 2016 or see incorrect information on their notice, should contact BC Assessment as indicated on their notice as soon as possible in January,” said Shah.

“If a property owner is still concerned about their assessment after speaking to one of our appraisers, they may submit a Notice of Complaint (Appeal) by January 31, for an independent review by a Property Assessment Review Panel,” added Shah.

The Property Assessment Review Panels, independent of BC Assessment, are appointed annually by the Ministry of Community, Sport and Cultural Development, and typically meet between February 1 and March 15 to hear formal complaints.

Changes in property assessments reflect movement in the local real estate market and can vary greatly from property to property. When estimating a property’s market value, BC Assessment’s professional appraisers analyze current sales in the area, as well as considering other characteristics such as size, age, quality, condition, view and location.

Real estate sales determine a property’s value, which is reported annually by BC Assessment. Local governments and other taxing authorities are responsible for property taxation and, after determining their own budget needs this spring, will calculate property tax rates based on the assessment roll for their jurisdiction.

BC Assessment’s assessment roll provides the foundation for local and provincial taxing authorities to raise over $7 billion in property taxes each year. This revenue funds the many community services provided by local governments around the province as well as the K-12 education system.

Lead image: The view across Lake Windermere of the Purcell Mountains remains the priciest in the region. Ian Cobb/e-KNOW photo

e-KNOW